댓글 0

등록된 댓글이 없습니다.

Within the ever-evolving panorama of personal finance and funding, Individual Retirement Accounts (IRAs) have lengthy been a cornerstone for retirement planning. Among the varied types of IRAs, Treasured Metals IRAs have gained considerable attention lately. This article aims to provide an observational analysis of Precious Metals IRAs, exploring their construction, benefits, risks, and the rising interest among buyers.

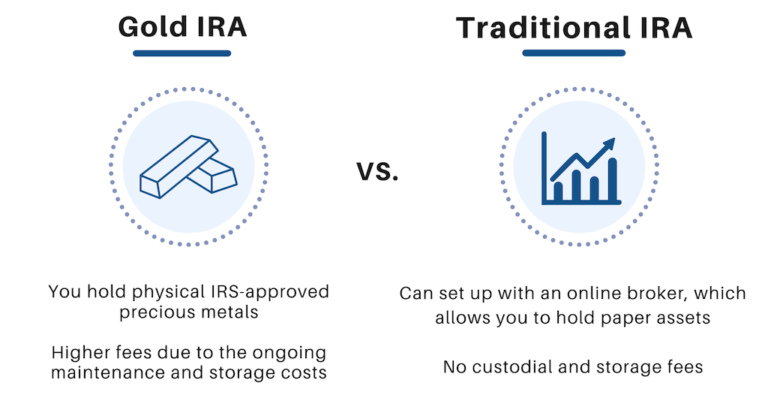

A Precious Metals IRA is a specialised type of self-directed IRA that enables traders to incorporate bodily precious metals, akin to gold, silver, platinum, and palladium, of their retirement portfolio. Not like traditional IRAs, which usually hold stocks, bonds, or mutual funds, Treasured Metals IRAs provide a tangible asset that can function a hedge in opposition to inflation and financial uncertainty.

To ascertain a Precious Metals IRA, buyers should first arrange a self-directed IRA account through a custodian that makes a speciality of precious metals. This custodian is accountable for managing the account and guaranteeing compliance with IRS laws. As soon as the account is established, traders can fund it by way of contributions or rollovers from other retirement accounts. The following step involves choosing the valuable metals to be included in the portfolio, which must meet specific purity requirements set by the IRS.

One in all the first advantages of investing in a Precious Metals IRA is the potential for wealth preservation. Precious metals, notably gold and silver, have historically maintained their value during occasions of economic instability. This characteristic makes them a pretty option for investors seeking to safeguard their retirement savings against market fluctuations and inflation.

Moreover, Precious Metals IRAs provide tax advantages similar to traditional IRAs. Contributions to a Precious Metals IRA may be tax-deductible, and the investments can develop tax-deferred till withdrawal. This function permits investors to maximize their retirement financial savings and potentially reduce their tax burden.

One other vital benefit is the diversification that valuable metals can deliver to an investment portfolio. By including physical assets like gold and silver, buyers can scale back their publicity to traditional monetary markets, which may be topic to volatility. This diversification technique can result in a more balanced and resilient retirement portfolio.

While Treasured Metals IRAs provide several benefits, they aren't without dangers and issues. When you have any kind of queries relating to where in addition to tips on how to make use of best gold ira investment options, you possibly can e-mail us on our webpage. One of the first concerns is the potential for greater charges associated with organising and sustaining these accounts. Custodial charges, storage fees, and premiums on the purchase of physical metals can add up, impacting general returns.

Furthermore, the marketplace for treasured metals might be unpredictable. Prices can fluctuate based mostly on varied elements, including geopolitical tensions, modifications in supply and demand, and shifts in investor sentiment. Consequently, traders must be ready for the opportunity of worth volatility and should rigorously consider their investment horizon and risk tolerance.

One other essential facet to consider is the liquidity of treasured metals. Whereas these assets will be sold for cash, the method will not be as simple as selling stocks or best gold ira investment options bonds. Traders might face challenges find consumers or may have to promote at a discount, particularly during instances of market downturns.

Regardless of the risks, curiosity in Precious Metals IRAs has surged in recent times. A number of factors contribute to this growing development. Economic uncertainty, rising inflation charges, and geopolitical tensions have prompted many traders to hunt different assets that may present stability and security.

Moreover, the growing consciousness of the benefits of diversifying retirement portfolios has led more people to explore the option of including treasured metals of their IRAs. Academic assets, on-line platforms, and monetary advisors have played an important position in disseminating details about Valuable Metals IRAs, making it easier for traders to navigate this funding avenue.

Moreover, the rise of digital property and cryptocurrencies has created a broader dialog about alternative investments. As traders search to balance their portfolios with both traditional and non-traditional belongings, Valuable Metals IRAs have emerged as a compelling choice.

In conclusion, Precious Metals IRAs represent a unique and precious alternative for buyers looking to diversify their retirement portfolios and protect their wealth towards financial uncertainty. Whereas they offer a number of benefits, including wealth preservation, tax advantages, and diversification, buyers should even be mindful of the associated dangers and prices.

Because the monetary panorama continues to evolve, the curiosity in Valuable Metals IRAs is likely to persist. Investors ought to conduct thorough analysis, search professional advice, and thoroughly consider their particular person financial targets and risk tolerance earlier than venturing into this investment house. By understanding the intricacies of Valuable Metals IRAs, people could make knowledgeable selections that align with their retirement planning strategies and long-time period financial properly-being.

0등록된 댓글이 없습니다.